How to create money

I think some people forget, or has never known, the origin of money. Or how money is created in 2024. I think that some also forget that money is just a representation of value, not value itself.

For example, a liter of water has more value than a million dollars, if you are stranded in the desert.

It was not until Nixon, in 1971, that the United States transitioned from a gold standard to fiat currency. Before Nixon and from the beginning of economy, there was some kind of backup commodity (gold, silver, copper, …) that gave money its value. Until Nixon, gold was the backup in the United States.. As commonly known, most reserve gold was kept in Fort Knox.

For example, shells were used in ancient times as coins. You could exchange shells for gold.

Papua New Guinea shell money. Photo Credit: Queensland Museum CC BY-SA 3.0

If you needed to print money, you needed to mine gold.

Given the impracticality of backing new money with commodities, it had to be discarded, and fiat money was introduced.

What is fiat money?

Fiat money is a type of currency that is issued by a government and declared legal tender, but not backed by a physical commodity such as gold or silver.

From Latin fiat “let it be done”, money started to be created into existence out of thin air.

More accurately, new money is printed when someone takes a credit and offers to pay interest. The interest is new money that didn’t exist before.

So, in a very real sense, paper money represents debt.

It doesn’t have to be this way

I have been trying to explain to my friends, that there is a way to responsibly print new money into existence without creating inflation.

If you print more money than the production machinery of a country can handle, inflation occurs.

But if the new money matches idle productivity capacity, it would be completely fine to print money and give it to people.

This was demonstrated in the United States during the pandemic, when ‘stimulus money’ was handed out to people.

Money

People live their lives chasing money, or money-equivalents, instead of value. Money is often seen as the ultimate goal, but in reality, it is only a tool—a medium of exchange that simplifies transactions. While money can facilitate access to resources and opportunities, it is not and should not be an end in itself.

It seems humanity has its pyramid of values upside down. More about this in a future article. Promise.

The true nature of value

Money doesn’t bring value. But wherever there is value, it has to be represented somehow.

Give people what they need

My same group of wonderful friends also laugh at me when I suggest the idea that giving free money to people would not only make people’s struggles diminish, making them happier, but it also stimulates the economy, benefitting the producer, consumer, and society as a whole as it would decrease petty criminality.

The deficit is a lie

Think about it, who do we have to pay that money that we printed back to? To us?

A government’s deficit is some else’s (a real person) surplus. Deficit spending can then be seen as investing in ourselves.

And by person, companies are legal entities owned by people.

Final words, for now

This topic is amazing. There is so much to discuss that I need to engage in dialogue with others. I am not writing a book on economics to prove my point.

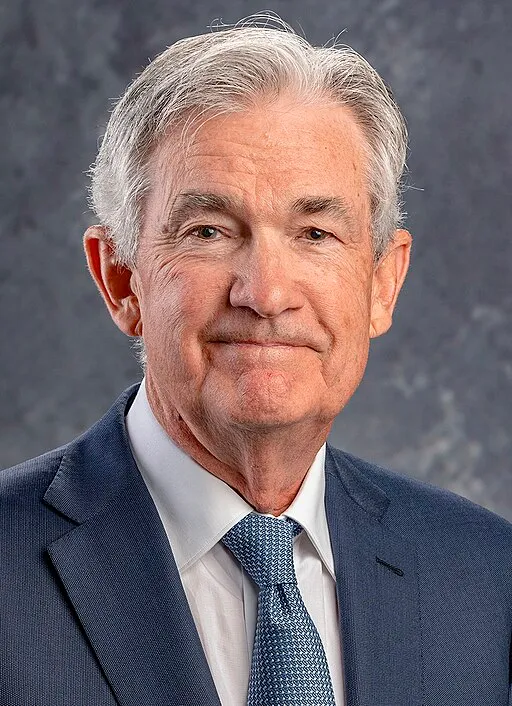

Jerome Powell, Federal Reserve chair.

Jerome Powell already did it and saved the U.S. from a recession during the COVID pandemic. He did it, but I think he doesn’t hold my same views.